ajr_photographs/iStock via Getty Photographs

Expense thesis

Booking Holdings’ (NASDAQ:BKNG) outcomes for Q1 FY12/2022 highlighted beneficial management commentary about gross bookings in April 2022 achieving pre-pandemic levels. Even with these beneficial data, the shares have reacted minimal. We believe that the cost of residing disaster will hit vacation behavior negatively into H2 FY12/2022, slowing the speed and scale of restoration. With consensus estimates wanting much too bullish, we amount the shares as neutral.

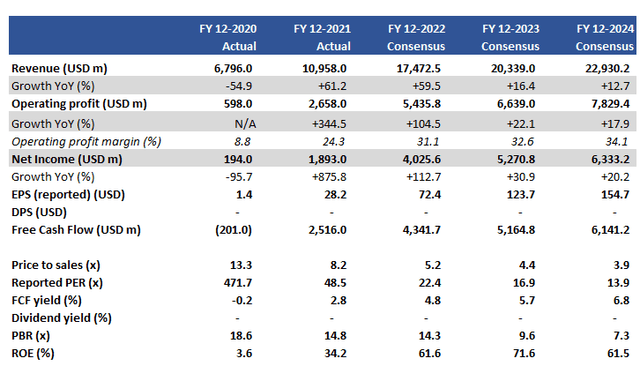

Important financials and consensus earnings estimates

Crucial financials and consensus earnings estimates (Organization, Refinitiv)

Our targets

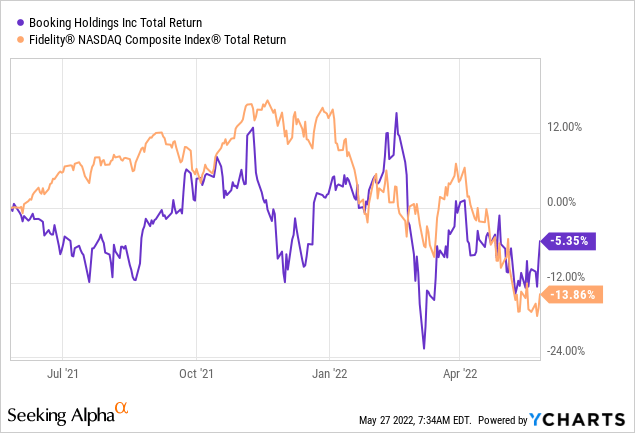

The loosening of journey limitations publish COVID19 ought to herald a period of time of robust demand from customers for Scheduling Holdings, coming in the kind of pent-up demand from both company and leisure travelers. Booking’s shares have outperformed the NASDAQ Index in the past 12 months but not by a really big margin.

In this piece we want to assess the pursuing:

- Assess the amount of present demand for travel, and its outlook offered the softer outlook in customer sentiment.

- Revisit our promote advice from March 2021, using into account consensus estimates for the next two many years.

We will acquire just about every one particular in transform.

Demand remains soft

The summary we arrive to is that sad to say for the vacation marketplace, need currently stays softer than hoped. With numerous parts of the entire world going through a value of residing disaster, and the Russian invasion of Ukraine resulting in a significant improve in the cost of essential items, we think this will have a important negative impression on the foreseeable future restoration of leisure journey.

We come across knowledge disclosed by the UNWTO (United Nations Planet Tourism Business) as one sign of the tourism industry’s wellness. Despite the fact that the details offered is not totally up to date, their Tourism Restoration Tracker spotlight constructive facts YoY in the recovery in travel sentiment and quick-expression rental demand for April 2022. Even so, what continues to be deeply negative YTD assortment from real air reservations down 70% YoY, lodge bookings down 69%, and very low hotel occupancy fees at 58%. There is evidence of restoration somewhere else, for instance, Japan has seen a 1,185% YoY enhance in abroad vacationers in April 2022 but this stays down 95% from the concentrations observed in pre-pandemic April 2019. The hurdle fees versus pre-COVID19 stages are really substantial.

The hazard from increasing expenditures will impact customers as properly as the hospitality trade by itself, which is also struggling with mounting input prices in power, foods and wine, and payroll. A likely fall in supply will also be a negative for journey websites as merchant volumes commence to fall off.

Small business vacation seems to be faring far better. American Categorical International Company Vacation (which is merging with SPAC Apollo Strategic Advancement Funds (APSG)) commented that the initially three months of April 2022 saw transactions achieve 72% of 2019 ranges. There seems to be stronger momentum listed here compared to leisure with the company globe returning to vacation. The issue here would be that with enterprise vacation building up around 20% of the complete industry, the field can only be truly saved with leisure volumes returning.

The consensus seems to be far too bullish (once again)

In our preceding remark in March 2021, we felt that consensus forecasts were being way too bullish, notably for small business journey restoration and we rated the shares as a market. This time, we imagine consensus is as soon as again being as well bullish for the subsequent good reasons.

For FY12/2022, we believe that the ‘bumper’ summer months of demand from customers is not likely to be sustainable. In the results connect with for Q1 FY12/2022, management commented that at Scheduling.com gross bookings for the summer season period have been around 15% better than at the very same place in 2019 – but a high share of these bookings ended up cancelable and the scheduling window had recovered (folks reserving ahead had been related to pre-pandemic stages, for this reason have sufficient time to cancel). The key concern is in excess of how sustainable this demand profile is as opposed to a just one-time restoration from pent-up demand from customers. With the present macro surroundings, we simply cannot envisage a steady recovery that spills above into H2 FY12/2022.

What also would seem much too bullish is consensus estimating that the company’s annual revenues will hold recording double-digit advancement into FY12/2023 (+16.4% YoY) and FY12/2024 (+12.7% YoY). In the heady times of growth involving FY2015-2019, the business grew sales by 13.% YoY CAGR – we uncover it pretty tricky to imagine that it can match these development costs looking at inflationary value pressures, falling criteria of residing, and increased hurdles YoY.

The two recent locations of weak point for the organization are the Asia current market and prolonged-haul worldwide journey. With vacation limits getting to be lifted, there will be a surge in demand but the issue will be the charge of recovery in ADR (normal everyday premiums) in lodging which will consider some time. Also, in the globe of distant function, the need to have for organization vacation has fallen which will have a lasting influence on intercontinental journey volume.

Reserving Holdings could goal to improve current market share to speed up topline expansion, but we believe that the in general marketplace pie requirements to extend for the firm to accomplish per consensus estimates. This does not glance very likely to us at this position.

Valuations

On consensus estimates (in the desk earlier mentioned in the Critical Financials portion) the shares are trading on a free of charge money movement yield of 5.7% for FY12/2023. This is an eye-catching generate and would put the shares in the undervalued group. Having said that, with consensus estimates showing much too bullish we believe a additional sensible generate to be around 4%. Consequently, the shares look additional reasonably valued.

Risks

Upside possibility will come from a sustained need recovery in leisure vacation as restrictions are lifted and individuals get started to allocate paying on holiday seasons. The business has witnessed potent figures in April 2022, and if these kinds of traits keep on the outlook is beneficial.

A relatively swift finish to the Russian invasion of Ukraine will assist in lifting purchaser sentiment as well as inserting some downward pressure on inflation (especially for agricultural food charges).

Draw back possibility comes from the improve in the value of dwelling which leads to tourists ‘trading down’. The selection of accommodation concentrates on decrease priced inventory ensuing in falling ADR and revenues.

A protracted conflict in Europe risks having other sovereign nations around the world acquiring involved, which would spot force on the European journey marketplace. The cancellation fee may well enhance as a consequence.

Summary

Inspite of encouraging reviews from administration about latest investing, the firm’s shares have reacted very little. We set this down to the industry assessing the danger of a international economic downturn and the negative effect this will have on holiday getaway behavior. Whilst we anticipate a restoration for the business, we think the tempo and scale will be slower and smaller sized than latest consensus estimates. With sector anticipations being reasonably significant, we now rate the shares as neutral.