If you’re searching for the best travel insurance, you might have come across SafetyWing. In this SafetyWing review, we’ll look at their policies to help you decide if it’s the right travel insurance for you.

This guide will provide information about SafetyWing, how it works, who it is for, and more. By the end of our review, you’ll know everything you need to know about SafetyWing travel insurance.

PSSST. Your travel medical insurance can now cover COVID-19!

If you grab SafetyWing Nomad Insurance, it’ll be covered just like other illnesses. I’ve been using it since 2019 and I can assure you it’s the perfect solution for nomads like you and me.

What Is SafetyWing?

SafetyWing is a travel insurance company that offers comprehensive coverage for travelers. They have two main products:

- Nomad Insurance: insurance for nomads like the name suggests.

- Remote Health: global health insurance covers your employees and contractors worldwide under one plan.

They are currently working on more products like Remote Doctor and Remote Retirement, so we’ll keep an eye on them for you and update this review when they are launched.

How Does SafetyWing Work

You’ll first need to decide on a product. Are you looking to insure your startup team, or are you looking for personal medical insurance?

Once you know which product you need, SafetyWing makes it easy to sign up and get started. For example, with Nomad Insurance, you’ll need to create an account and provide some personal information. Then, you can set up an automatic monthly payment if you’re going on a long trip.

If you’re buying Remote Health insurance, you’ll need to provide some information about your team.

Once you have everything set up, you can rest assured that you’re covered in case of an emergency. SafetyWing will take care of the rest.

Now, in this review, we want to focus on Nomad Insurance, so let’s dive deeper into it.

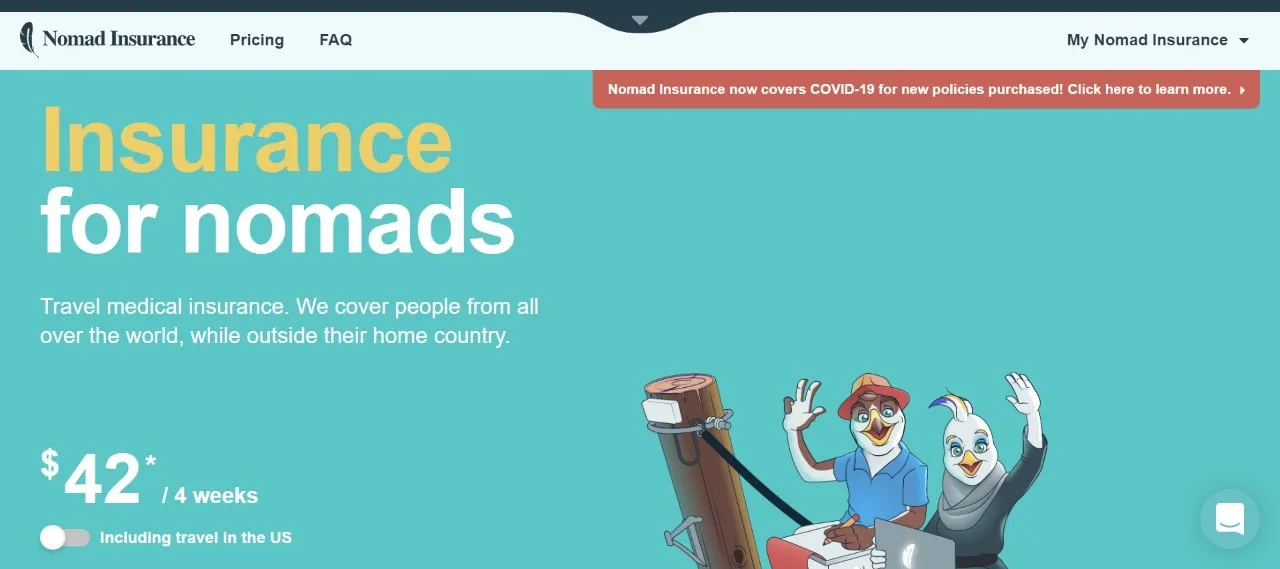

Nomad Insurance Plan

With the Nomad Insurance plan, you’ll get medical and travel insurance. Let’s take a quick look at what this means.

Medical Insurance

SafetyWing covers you if you are in an accident or fall sick while outside your home country and need medical assistance.

- Max Limit: $250,000 ($100,000 for 65 years and above)

- Deductible: $250

- Hospital: Room and nursing services

- Intensive care: Up to the overall maximum limit

- Ambulance: Usual, reasonable, and customary charges when covered illness or injury results in hospitalization

- Urgent charges: $50 co-payment, not subject to the deductible.

- Physical therapy and chiropractic care: Up to $50 per day. Must be ordered in advance by a physician.

- Emergency dental: Up to $1,000. Not subject to the deductible.

- All Other Eligible Medical Expenses: Up to the overall maximum limit.

- Notable exclusions: High-risk sports activity, pre-existing disease or injury, cancer treatment

If you wish to learn more about the policy, you can read the full details on SafetyWing’s website.

Travel Insurance

The travel insurance includes coverage for travel delay, lost checked luggage, emergency response, natural disasters, and personal liability.

- Trip interruption: Up to $5,000. No deductible

- Travel delay: Up to $100 a day after a 12-hour delay period requiring an unplanned overnight stay. Subject to a maximum of 2 days. No deductible

- Lost checked luggage: Up to $3,000 per certificate period; $500 per item. Up to $6,000-lifetime limit. No deductible.

- Natural disaster — a new place to stay: Up to $100 a day for 5 days. No deductible

- Political evacuation: Up to $10,000 lifetime maximum. Not subject to deductible

- Emergency medical evacuation: Up to $100,000 lifetime maximum. Not subject to deductible or overall maximum limit.

If you wish to learn more about the policy, you can read the full details on SafetyWing’s website.

Features

Nomad Insurance got an excellent reputation amongst long-term travelers, expats, and digital nomads because of its unique features.

- If you are between 18-39 years old, you can purchase Nomad Insurance for $42 per 4 weeks if you are not traveling to the United States or $77 per 4 weeks if you do.

- You can set up automatic monthly payments and stop the subscription anytime.

- You can buy insurance abroad, even when your trip is already started.

- You keep your medical coverage for 30 days in your home country if something happens while there after being abroad for 90 days. (15 days if your home country is the United States)

- You can include up to 2 children under 10 years old per family (1 per adult) free of charge.

- You can learn more about what is included here.

Who Is SafetyWing For

SafetyWing is an excellent solution for long-term travelers, digital nomads, and expats. If you are any of these, then SafetyWing Nomad Insurance should be on your radar.

If you are a student planning a gap year or semester abroad, SafetyWing can also cover you.

It’s important to note that depending on your age, the plan price will change. We’ll get back to this in the next section so keep reading to learn more.

SafetyWing Plans And Costs

As mentioned above, there are two types of plans on SafetyWing at the moment: Nomad Insurance and Remote Health.

We’ll discuss the costs for both products below.

Nomad Insurance Cost (Excluding Travel In The United States)

- 15 days-9 years old: included in the price of an adult insurance

- 10-39 years old: $42 per 4 weeks

- 40-49 years old: $68.04 per 4 weeks

- 50-59 years old: $106.68 per 4 weeks

- 60-69 years old: $144.76 per 4 weeks

Nomad Insurance Cost (Including Travel In The United States)

- 15 days-9 years old: included in the price of an adult insurance

- 10-39 years old: $76.72 per 4 weeks

- 40-49 years old: $126.56 per 4 weeks

- 50-59 years old: $208.04 per 4 weeks

- 60-69 years old: $284.20 per 4 weeks

Remote Health Insurance

- From $80 per month, per member

Pros And Cons

Now, let’s take a look at the pros and cons of using SafetyWing when traveling.

Pros

- You can buy the insurance even if you are already on your trip

- The price is very affordable compared to most travel insurance providers

- You can include your family members in the plan (up to 2 children under 10 years old)

- The insurance covers a wide range of countries

- You get coverage for up to 30 days in your home country if you need to go back for any reason

Cons

- There is no coverage after 69 years old

- The medical coverage is not as comprehensive as some other providers

- The deductible can be quite high

How Does SafetyWing Compare To Other Travel Insurance Providers?

A few things set SafetyWing apart from other travel insurance providers.

- The price is very affordable, especially for long-term travelers.

- You can buy the insurance even if you are already on your trip. This is perfect for last-minute travelers or if you extend your stay.

- The insurance covers a wide range of countries. You are only excluded from coverage if you travel to Cuba, Iran, Syria, and North Korea.

- You get coverage for up to 30 days in your home country.

My Experience With SafetyWing

I have been using SafetyWing for several years now, and I have had a great experience with them thus far.

SafetyWing also covers Covid-19, which is helpful because traveling during the pandemic can get tricky.

I have never had to make any claims so far (knocks on wood*), but the customer service has always been super responsive and helpful when I had questions.

I would recommend SafetyWing to anyone looking for an affordable and comprehensive travel insurance solution.

That said, many of my nomad friends have been using SafetyWing too, and I’ve heard great stories.

For example, a few of my friends could return home, thanks to SafetyWing, who evacuated them during the pandemic when countries were going into lockdowns.

How To Get SafetyWing Travel Insurance

You can get SafetyWing Nomad Insurance here.

If you are interested in their Remote Health Insurance, you can get it here.

Simply create an account, and provide your personal information. Then, you’ll be prompted to set up your monthly payment with your bank card details. Every 28 days, the insurance policy is going to renew automatically.

When your trip ends, simply stop the subscription, and the policy won’t be extended again… until your next trip!

Final Thoughts On SafetyWing Nomad Insurance

SafetyWing is an excellent option for budget-minded travelers who are looking for comprehensive coverage.

I have been using them for years, and I’ve always been happy with the service.

If you are looking for an affordable and comprehensive travel insurance solution, I would highly recommend SafetyWing.

If you’re hesitating between World Nomads and SafetyWing, I get it. For me, SafetyWing was a better option because I travel long-term.

Traveling long-term? You may also like the following guides: