Travel disruptions continue being best-of-thoughts for numerous travelers, in particular those with households. Booking that prolonged-deferred holiday vacation only to have it slide apart is a true worry. So insuring a excursion against unavoidable uncertainties can help you save people from journey losses — if accomplished appropriate.

International travel is roaring back again. For every the Worldwide Trade Administration, the variety of U.S. citizens leaving for intercontinental places in April 2022 was virtually 2.5 situations higher than the yr just before. But touring abroad still carries danger of vacation disruption.

According to an August 2021 AAA survey, 31% of U.S. vacationers say they are more probable to purchase travel insurance coverage for journeys as a result of the conclude of 2022 for the reason that of the ongoing COVID-19 pandemic.

But what are the most effective techniques to purchase journey coverage for a loved ones? And, for starters, what is vacation insurance plan, accurately?

Vacation insurance policy 101

Vacation insurance policy is a baffling time period for the reason that it appears like a one factor. In actuality, journey insurance companies give a buffet of insurance policy possibilities that can utilize to your travels. So asking a issue these types of as, “Does travel coverage cover journey cancellations?” is like asking irrespective of whether dwelling coverage addresses earthquakes — some sorts of protection do, and some really do not.

Individuals are also reading…

The most frequent sorts of travel coverage protection include:

- Health-related.

- Unexpected emergency evacuation and repatriation.

- Vacation cancellation and hold off.

- “Cancel For Any Reason.”

Like car coverage, most vacation coverage plans will cover several popular problems, and you can choose the certain added benefits for your journey. Your choices will have an affect on the overall value.

Just one of the a lot more frequent misconceptions about travel insurance plan is that it will address all improvements and cancellations. Several vacationers figured out the fact the really hard way when the pandemic commenced, and the value of their scuttled designs was not reimbursed by their journey insurance policies guidelines. Journey insurance is an umbrella time period, and only certain types of designs go over improvements and cancellations brought about by unexpected events.

Here’s the gist: If you’re looking for vacation coverage that covers adjustments induced by COVID-19 health issues and border closure, lookup for vendors that provide it specifically. It’s not constantly clever to acknowledge the insurance plan offered for the duration of checkout when you invest in travel through an airline or hotel website.

Does journey insurance policies cover relatives members?

Positive, you might get reimbursed for your vacation if you occur down with COVID-19 the working day prior to you are established to depart. But what if your toddler does?

For the most section, journey insurance policy coverage will give the selection to contain relatives customers. Some programs will incorporate youngsters 17 and youthful mechanically when they are touring with a parent. Some others will need that you increase every single relatives member individually to the approach.

This is an critical difference, specially when evaluating prices in between distinctive travel insurance coverage guidelines.

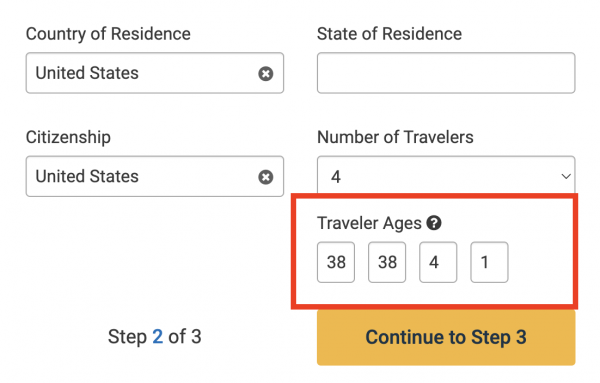

Working with a comparison resource can assist, especially if you never appreciate wading through the great print. You can enter your relatives members’ ages and the software will instantly issue those into its cost comparisons.

An insurance coverage comparison software like Squaremouth (a NerdWallet lover) can aid you find a enough plan. (Screenshot courtesy of Sam Kemmis)

Of program, you can always double-verify the conditions and ailments to make absolutely sure each and every family member is included sufficiently. But working with a comparison instrument in this way can conserve a big trouble.

Take into consideration other versatile options

The pandemic has shifted the world of vacation insurance plan to concentration a lot more on adaptability. But it truly is experienced the exact same result during the vacation environment.

Airlines and inns now typically offer much more flexible reserving alternatives. With the noteworthy exception of simple financial state airfares, which generally just cannot be transformed or canceled, airline tickets are now much much more versatile than they were being two yrs ago.

It’s also the case that various top quality credit history playing cards include vacation insurance policy as a developed-in gain for any bookings created with these cards (although coverage policies differ).

What does this indicate for traveling family members? It may possibly make sense to make adaptable bookings relatively than purchase family members vacation insurance policies that covers variations and cancellations. The other rewards of vacation coverage, these kinds of as health-related coverage, could possibly nonetheless be a smart shift. But make absolutely sure you’re not finding cancellation coverage for a excursion that is now really flexible.

The base line

Touring with an full household can be a major price. And like any cost, it can be clever to insure it.

Most journey insurance policy procedures will address family members, both immediately or for an supplemental charge. The best way to examine plans is to use a travel insurance policies comparison resource, enter your relatives members and journey particulars, and pick out the approach that will make perception for you.

Try to remember: Not all plans include the identical thing. If you’re fearful about cancellations induced by COVID-19, make absolutely sure to lookup for that coverage precisely. And consider other adaptable booking solutions past insurance coverage when making strategies.

The article Spouse and children Travel Insurance policy Could Save Your 2022 Excursion Spending budget at first appeared on NerdWallet.