Thomas Barwick/DigitalVision by way of Getty Visuals

Vacation + Leisure Co. (NYSE:TNL) has been dealing with challenges in excess of the past few of many years, owing to COVID-19 pandemic and volatile demand from customers dynamics in the hospitality sector. As the financial system reopened so as well did Vacation + Leisure’s small business but matters search established to stall once more. Investing in timeshare corporations at the starting of a new small business cycle can generally offer chances for substantial returns. Timeshares are a really cyclical business so it functions the two approaches. In downturns, luxury large-ticket things like timeshares get strike the toughest but the rebrand to Vacation + Leisure gave Wyndham Destinations a number of new tools to assistance the company cope during hard periods like these. Nowadays we are going to just take a search at some of the newest resources and see how they could be benefiting buyers in the around long run.

The Product

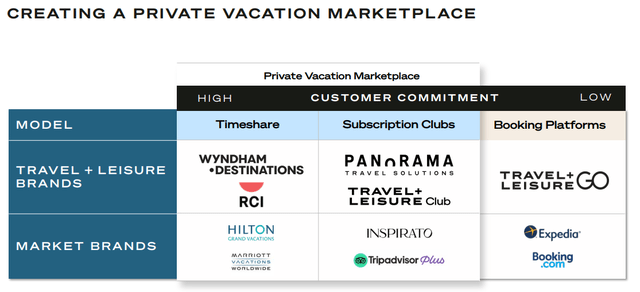

Travel + Leisure is nevertheless a timeshare firm, but their unique get on the product or service differentiates them. As an alternative of a common timeshare, Journey + Leisure sells holiday vacation golf equipment. Members can style their have vacations and they can use their ownership in a selection of techniques. It was the Apple iphone second for Journey + Leisure. They also even now get upkeep expenses for their timeshare offerings which is a useful sort of passive revenue. This allowed the corporation to target on setting up a sturdy portfolio as an alternative of acquiring and advertising and marketing just one select location at a time.

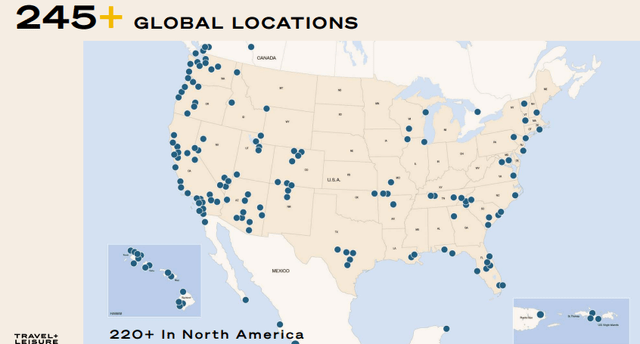

Obtaining a powerful hotel portfolio is highly-priced and creates a enormous barrier to entry for competitors as they have to go up in opposition to an whole fleet of hotels versus just a person interesting place and the TNL portfolio features some 245 areas in some of the most appealing locations.

Travel + Leisure

As a final result, the benefit of timeshare stocks depends mainly on the range of solutions and areas they give. Obtaining a deep spot catalog makes it harder for competitors to poach clients and is a important advertising level for new clients. It also offers shareholders assurance in the company’s potential to hold present-day consumers. Travel + Leisure has performed well setting up up its catalog.

Travel + Leisure also has the RCI Exchange that facilitates the buying and selling of timeshare- and it’s a person of the world’s premier by volume. They are basically a just one-end shop for all issues timeshare and it often appears to be associated in any impressive methods in the room.

Some queries have been elevated about the timeshare industry’s capacity to attract millennial money, but there are some efforts underway that really should help it strengthen. Vacation + Leisure began giving subscription expert services to millennials who usually are not as probable to commit to a lengthy-phrase investment. The introduction of Panorama’s membership providers could be pivotal for Vacation + Leisure, specially in mild of the latest competition from Airbnb and other short-phrase lodging items. Membership expert services could very very well close up being the upcoming frontier in the timeshare market.

Journey + Leisure

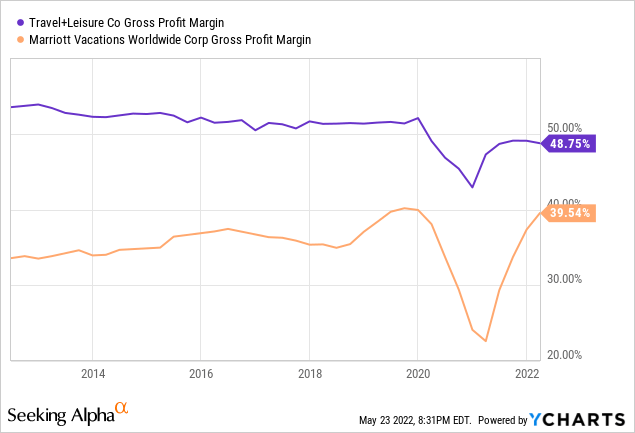

Sturdy Gross Margins Post Recovery

Thanks to an enhanced value proposition relative to higher hotel prices and powerful work figures, TNL’s long term outlook is on the lookout promising.

The company enjoys robust gross margins because of to pricing power but they have been declining. The Wyndham Places choices exist at the medium amount of the pricing spectrum. In contrast to more deluxe choices like the Marriott Holidays golf equipment, you would hope Travel + Leisure’s choices to have significantly less favorable margins but they basically outperform.

This is truly a testament to the organizational performance of the management group. Prices have been equipped to balance out the fees, leading to greater revenues. Regulate over routine maintenance agreements and a stable fee-centered product let the corporation to proficiently move on costs to consumers.

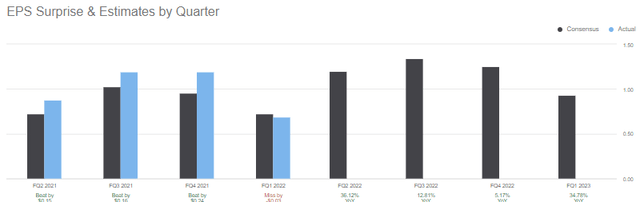

The restoration has seriously taken root for the corporation. EPS traits have been favorable until finally a short while ago. The firm has a cyclical ingredient to profits and has not long ago been beating estimates for the most component.

Seeking Alpha

Most notably in their family vacation possession enterprise, the firm had an average VPG (quantity per guest) of $3,377 in Q1 is better than ever ahead of for the company and 40% earlier mentioned past year’s quantities. It is also significant to keep in mind that inflation is great for their corporation. Costs for hotels and getaway residences are soaring. This aids include worth to the timeshare thought for shoppers as it results in being far more price tag-efficient relative to staying in other varieties of accommodations. Curiosity rates growing on the other hand are a lot more concerning.

Lousy Disorders for Cyclical Plays

Reports from the Federal Reserve advise that we are heading in the direction of amount hikes between 3-5 moments this yr. This will be the to start with time prices have increased because the start of the pandemic-induced lockdowns and it could impact financial expansion and equity price ranges. What is actually far more, there is a inclination in the timeshare business to finance purchases so a extended period of greater prices will improve the over-all price tag of VO merchandise to the buyer.

Extensive-time period buyers who hold their eyes open up ought to have lots of options if they continue to be diversified. The industry has been having extra risky as charges increase and points get tenser overseas.

They influence the volatility of shares and their multiples. When curiosity charges are large, stocks are much less eye-catching mainly because they supply decreased returns.

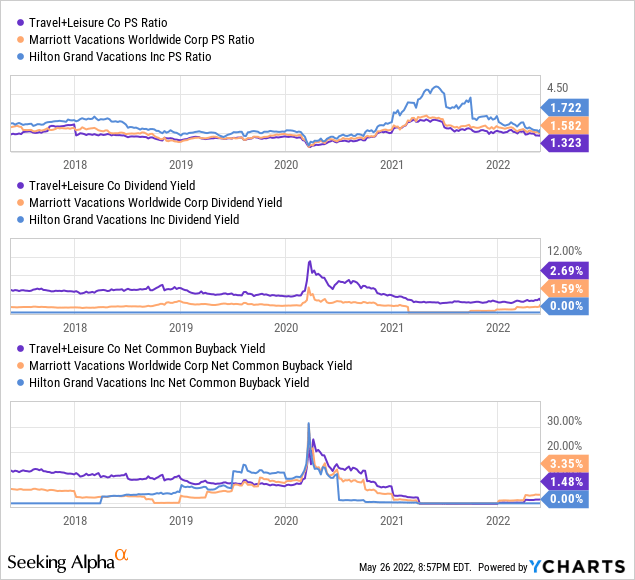

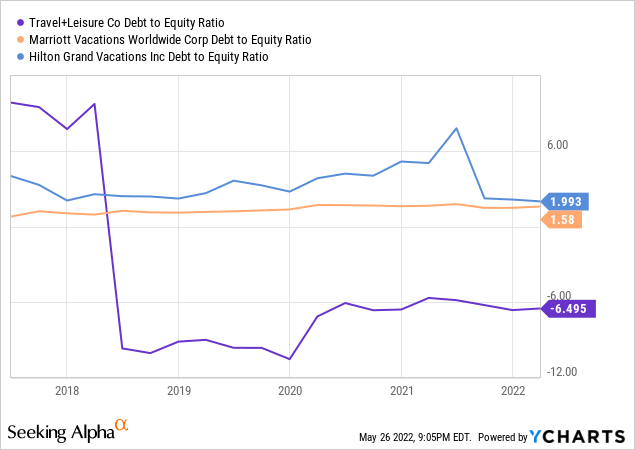

The hospitality field is a person of the most affected by curiosity premiums because organizations have a tendency to have a significant personal debt-to-equity ratio.

This usually means that when desire rates go up, so does the charge of borrowing revenue for these organizations. This places timeshare organizations in a challenging spot. They have to spend a lot more to borrow money simply because of the fascination costs. They tend to avoid this by building reasonably stable agreements with preset prices for revolving traces of credit. This is where by Travel + Leisure stands out in opposition to its peers. They have almost no credit card debt and no urgent need to have for liquidity injections. It is likely that they may perhaps safe credit rating to beef up the stability sheet if the financial state was to go south in a significant way but the company has performed this sort of a excellent job taking care of its liquidity and overall charge of cash that such a go really should be immediately forgiven if it were being to take place.

There is also the point that a recession is not all doom and gloom for larger experience players like Journey + Leisure. There is generally place for key acquisitions at useful rates and Wyndham has performed some amazing bargains in the past. Travel + Leisure is an outgrowth of the Wyndham manufacturer but it will be intriguing to see if they can have identical results in the function of a downturn.

Summary

Journey + Leisure is quite valued right now. We could be heading into a major slowdown and they phone hospitality a cyclical perform for a cause. I’m under no circumstances heading to propose shopping for a timeshare inventory on the cusp of a recession but there is a ton to appreciate about Journey + Leisure below. The inventory has marketed off a good deal but it could even now go decreased. I would not be in a hurry to buy just nevertheless but I see no cause why buyers must hurry to section with their shares at this degree. I charge the stock as a Hold.