Andrea Vumbaca/iStock by using Getty Photos

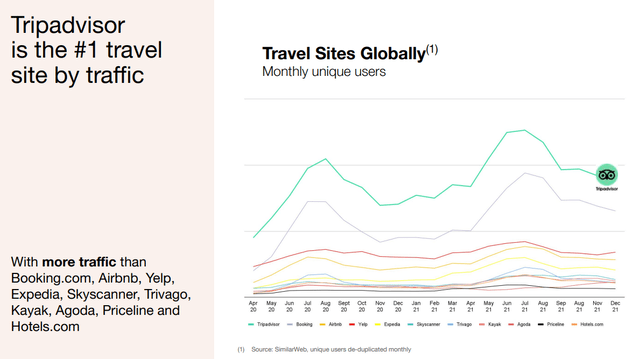

Tripadvisor (NASDAQ:Vacation) is a firm with so significantly probable. It is unhappy to see they are obtaining so a lot trouble monetizing the web-site. Extremely, it has a lot more site visitors than even Reserving.com (BKNG) or Airbnb (ABNB). Nonetheless, the organization has struggled to come across the ideal organization model to transform guests trying to get to browse opinions into revenue for the firm. Continue to, even though very low for the range of visits, the corporation does deliver some revenue and functioning funds move, and we think shares are at this time incredibly low-priced assuming journey recovers in 2022.

Tripadvisor Investor Presentation

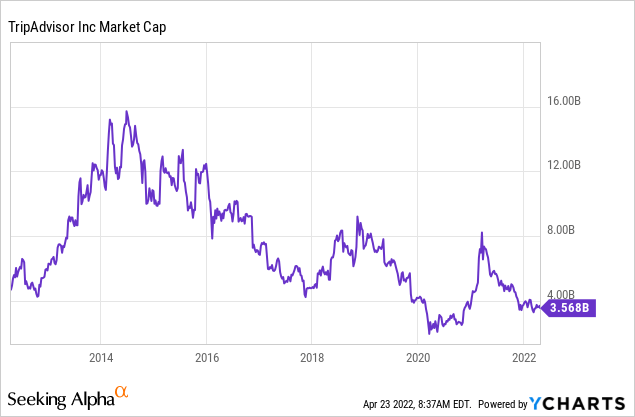

Tripadvisor is investing with a marketplace cap that is hardly ~3.5% that of Airbnb, which helps make us think that if the company does not figure out the correct enterprise model, then anyone will most likely provide to acquire them out and determine it out for them.

Administration tried out to resolve the monetization difficulty by supplying a subscription provider identified as Tripadvisor Plus, but so much it has not genuinely achieved anticipations. The subscription, which presented up-front lodge discount rates to subscribers for $99 per 12 months, ran into rigid opposition from big lodge chains about charge parity concerns. It is currently transitioning to offering a lot less appealing cashback payments right after stays.

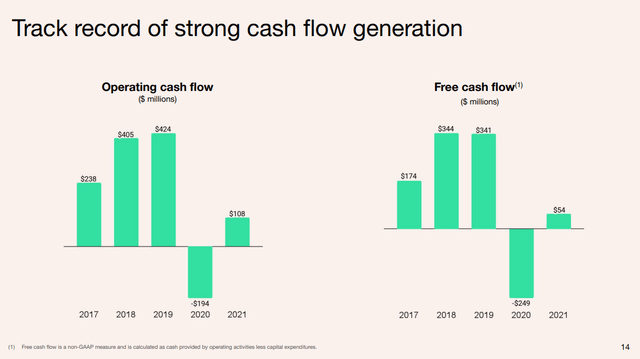

Pre-pandemic Tripadvisor was in a position to generate much more than $400 million per yr in working funds stream, and additional than $340 million in free income move. Evaluating these quantities to the current market cap, we see that the company is scarcely trading at ~10x this income move range. If there is a total vacation recovery, the firm really should in idea be in a position to crank out even extra earnings and free of charge money circulation, offered that it took out additional than $200 million in charges from its charge construction immediately after the pandemic, and has said that a important portion of these financial savings need to keep on being article-restoration.

Tripadvisor Investor Presentation

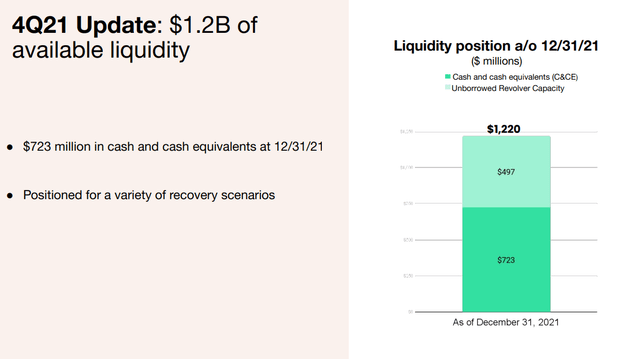

Fortunately, the firm has more than enough liquidity to wait around for the vacation restoration to arrive, even if it is not in 2022, but in 2023 or 2024 rather. Tripadvisor has far more than a billion dollars of liquidity amongst dollars and equivalents, and unborrowed revolver potential.

Tripadvisor Trader Presentation

Valuation

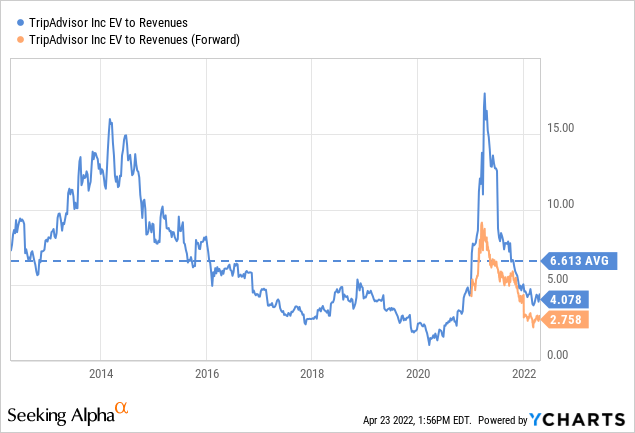

We can see how very low the valuation has gotten by wanting at the EV/Revenues a number of and review it to its historical typical. This multiple is more than a third underneath the common, and the ahead many is considerably less than 50 % this historical typical.

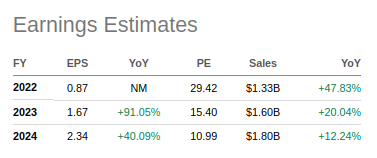

Analysts are anticipating earnings to noticeably enhance in the following pair of several years. The ordinary estimate for FY24 is currently $2.34, which provides an FY24E P/E of 10.9x.

Trying to find Alpha

Growth and likely catalysts

There is expectation that in 2022 vacation will have recovered to 2019 levels, significantly benefiting the company. Specifically, as we talked about, thanks to the fees it took out proper after the pandemic begun. The firm expects these price savings will proceed even soon after a full recovery. This should really make the business more successful than it was pre-pandemic.

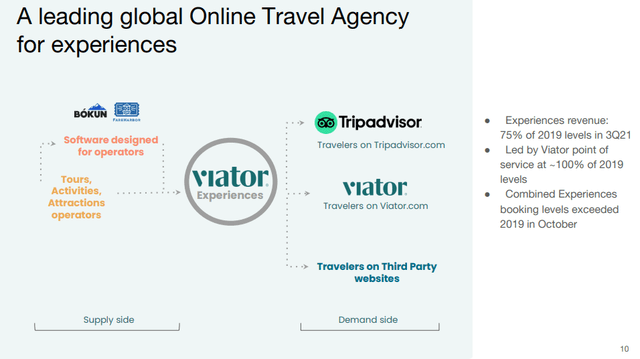

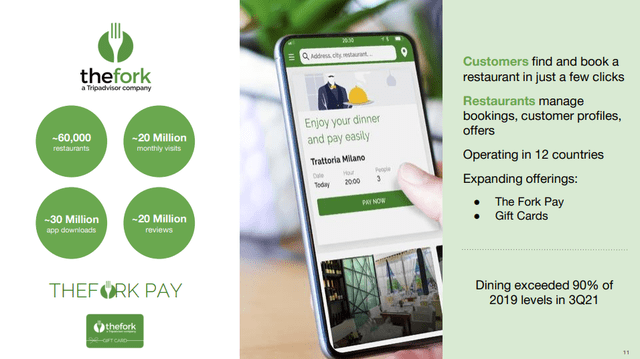

There are other possible catalysts to unlock value further than a possible takeover. One would be a effective re-designed membership service. Even though the 1st endeavor at Tripadvisor Plus experienced problems, the corporation is hoping to modify the item and to relaunch quickly. Two other growth segments are Viator and LaFourchette. Viator is the primary market for journey experiences and has been developing at a really fantastic tempo. LaFourchette is a cafe reservation software that will work primarily in Europe, comparable to OpenTable in the US industry. The two of these firms have noticed a quicker restoration than the main Tripadvisor Resort small business. Tripadvisor is also thinking about offering to public shareholders a minority stake in Viator, with Tripadvisor retaining command of the manufacturer. This could unlock some worth and demonstrate buyers how substantially this organization is truly worth to the organization. Tripadvisor already submitted a private S-1 draft registration statement with the SEC.

Liberty TripAdvisor Trader Presentation

Opponents GetYourGuide and Klook have been valued at much more than a billion pounds, so Viator could unquestionably shift the needle for Tripadvisor. In particular taking into consideration that Viator is considered the leader of the reserving encounters sector. Ordeals booking stages exceeded 2019 stages in October 2021.

Liberty TripAdvisor Investor Presentation

TheFork (LaFourchette) operates in 12 nations and partners with ~60,000 restaurants to manage reservations for them. It is a different Tripadvisor small business that is growing immediately and at some point could also be thought of for an IPO, a spin-off, or a sale.

Liberty TripAdvisor Investor Presentation

Summary

Tripadvisor shares are genuinely low-cost, specially if a full vacation recovery comes quickly. With the charges that have been taken out of the organization, it has the prospective to be additional profitable than in advance of, and the company is experimenting with strategies to much better monetize its substantial net targeted traffic. There is also the risk that it may well grow to be an acquisition goal from a different business that has some tips on how to monetize all the visits it gets. There is also a large amount of benefit in some of the other organizations Tripadvisor holds, these as Viator and TheFork.